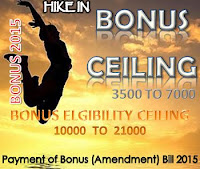

Government approves hike in bonus ceiling from Rs. 3500 to Rs 7000

NEW DELHI: The Cabinet decided to double the wage ceiling for calculating bonus to Rs 7,000 per month for factory workers and establishments with 20 or more workers.

“The Payment of Bonus (Amendment) Bill, 2015 to enhance the monthly bonus calculation ceiling to Rs 7,000 per month from existing Rs 3,500 was approved by Union Cabinet here,” a source said after the Cabinet meeting.

The amendment bill will be made effective from April 1, 2015. Now the bill will be tabled in Parliament for approval.

The bill also seeks to enhance the eligibility limit for payment of bonus from the salary or wage of an employee from Rs 10,000 per month to Rs 21,000.

The bill also provides for a new proviso in Section 12 which empowers the central government to vary the basis of computing bonus.

At present, under Section 12, where the salary or wage of an employee exceeds Rs 3,500 per month, the minimum or maximum bonus payable to employees are calculated as if his salary or wage were Rs 3,500 per month.

The last amendment to both the eligibility limit and the calculation ceilings under the said Act was carried out in 2007 and was made effective from April 1, 2006.

This amendment in the Act to increase wage ceiling and bonus calculation ceiling was one of ssurances given by the Centre after 10 central trade unions went on one-day strike on September 2.

The government had hinted at meeting workers’ aspirations on nine out of 12 demands submitted by the unions.

Source : AIRF

Comments

Then why did the announcement make now ? its nothing but a PURE ELECTION ( in Bihar ) GIMMICK. After one year, when the CG Employees will get the benefits of this announcement, in the mean time the money will have its devaluation and this 7000/- limit actually will be at around Rs.5000/- approximately.

BJP Govt.is very cunning. Actually they don't want to give any monetary benefit to CG Staff, that is why they extend the duration of 7th CPC to Dec' 15 whereas the said 7th CPC Report was ready to submit in August '15. They actually do this to avoid to pay the arrears of other allowances for three months i.e., from Jan '16 to Mar '16.