Web-based Pensioners Portal Project - Pensioners’ Portal

Web-based Pensioners Portal Project – Release of Grant-in Aid to Pensioners Associations for implementation of the objectives of the Portal

F.No.55/23/2017-P&PW(C)

Government of India

Ministry of Personnel, P.G. and Pensions

Department of Pension & Pensioners’ Welfare

3rd Floor, Lok Nayak Bhavan,

Khan Market, New Delhi-110003

Dated-9th/13th Februrary, 2018

The Pay & Accounts Officer,

Department of Pension & Pensioners’ Welfare,

Lok Nayak Bhavan, Khan Market, New Delhi.

To

Subject: Web-based ‘Pensioners’ Portal’ Project – Release of Grant-in Aid to Pensioners’ Associations for implementation of the objectives of the Portal.

Sir,

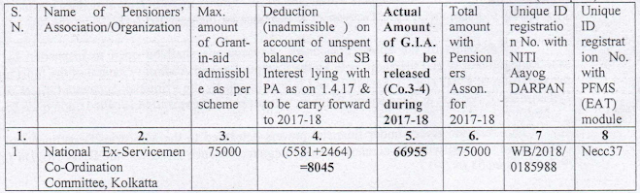

I am directed to refer to this Department’s sanction of even number dated 21.9.2017 (copy enclosed) authorizing grant in-aid in favour of 21 identified Pensioner Associations total amounting to Rs.14,16,389/- against which an amount of Rs.6,83,207/- payable to 10 Pensioner Associations, an amount of Rs.540352/- to 8 Pensioner Associations and an amount of Rs.1,25,815/- to 2 Pensioner Associations had already been released vide sanction letter of even number dated 28.9.2017, 30th October,20 17 and 6th December,20 17 respectively. This sanction is for further release of sanctioned amount of Rs.66955/-(Rupees Sixty Six Thousand Nine Hundred Fifty-Five only) in favour of under-mentioned 1 Pensioner Association on their having been registered under NITI Aayog DARPAN and having been linked with PA&O under PFMS, as per details given in Col.5 of the Table given below :-

2. This Department also undertake on behalf of respective Pensioner Associations that funds utilization towards the expenditure to be incurred on approved components will be done through EAT module mapping for which has already been done under DARP AN in PFMS module. The Pensioner Association thus needs to fulfill this undertaking given by this Department

3. The. above Pensioners Association is, therefore, advised to book the utilization of funds for approved components under the Scheme of GIA through EAT Module under PFMS. Any expenditure incurred otherwise than through EAT module will not qualify for adjustment against the Grant-in-aid being sanctioned and released and the Association will be liable to refund such amount to this Department.

4. All the Pensioners Associations can access the Eat Module under PFMS by creating log-in-id and password The Log-in-ID of each Pensioner Association is Unique ID under EAT Module of PFMS which is indicated against each Pensioner Associations in Column ‘8″ of the Table under Para’ 1′ above. For getting the password the Association need to first fill the log-in-id ( as indicated in column ‘8’ of the above Table) and use the facility of ‘Forget Password” to get the fresh Password by authenticating OTP which they will receive from PFMS on the registered mobile number and E-mail by PFMS as mentioned earlier in the agency details under PFMS. After filling the OTP sent by the PFMS, the Association will get the option of ‘Change Password’. Accordingly, the Association will be able to create the new password for Log-in-ID. If, ‘any help is needed to create log-in-ID and password in EAT module of PFMS and acquainting themselves with other functions including booking of expenditure in EAT module, they may contact this Department for arranging necessary training etc. for them. If, any help is needed to create log-in-ID and password in EAT module of PFMS and acquainting themselves with other functions including booking of expenditure in EAT module, Please visit link for training videos on PFMS/EIS/EAT Module https:/ Iwww.youtube.com/channeIlUCzHOkge912RyA45AlpQ3BSA. For further clarification you may contact Mr. OM Pathak, Trainer PFMS-EAT module on his mobile No. 07828594200 OR land line no. 011/24641225. In case of emergency and non-availability of PFMS trainer you may contact Shri Rajeev Ranjan, AAO, P&AO on his land line No. 011124626133 and Mr. Rajesh Jain, Sr. A.O., Incharge PFMS-EAT Module on his telephone No. 011-24626331.

5. The Drawing & Disbursing Officer of the Department of Pension & Pensioners’ Welfare is authorized to draw the amount as mentioned in Col 5 of Table given in para 1 above for disbursement to the Grantee Pensioners’ Association for transferring the amount to the Bank Accounts of respective Pensioners’ Associations.

6. The expenditure involved is debitable to Major Head “2070”- Other Administrative Services 00.800.0ther Expenditure, ( Minor Head); 43-Plan Scheme of Department of Pensions and Pensioner Welfare, 43.01-Pensioners Portal; 43.01.31- Grants-in-Aid-General under Demand No.-

70 Ministry of Personnel, Public Grievances & Pensions for the year 2017-18.

7. The accounts of. the above Pensioners’ Associations shall be open to inspection by the sanctioning authority and the audit, both by the Comptroller and Auditor -General of the India under the provision of CAG (DPC) Act, 1971 and internal audit by the Principal Accounts Officer of the Department of Pension & Pensioners’ Welfare, whenever the organization is called upon to do so.

8. This sanction issues under financial powers delegated to the Ministries/Departments of the Government of India with the concurrence of Integrated Finance Division vide Diary No. Dir (F/P)/P 4625 dated 04.09.2017.

9. The expenditure of Rs.66955/-(Rupees Sixty Six Thousand Nine Hundred Fifty-Five only) has been noted in the grant-in-aid register for the year 2017-2018.

10. The release of GlA through this Sanction will be governed by the terms and conditions contained in this Department Sanction of even number dated 21.9.2017 referred to above.

Yours faithfully,

sd/-

(Manoj Kumar)

Under Secretary to the Govt. of India

Authority: http://www.pensionersportal.gov.in/

Comments